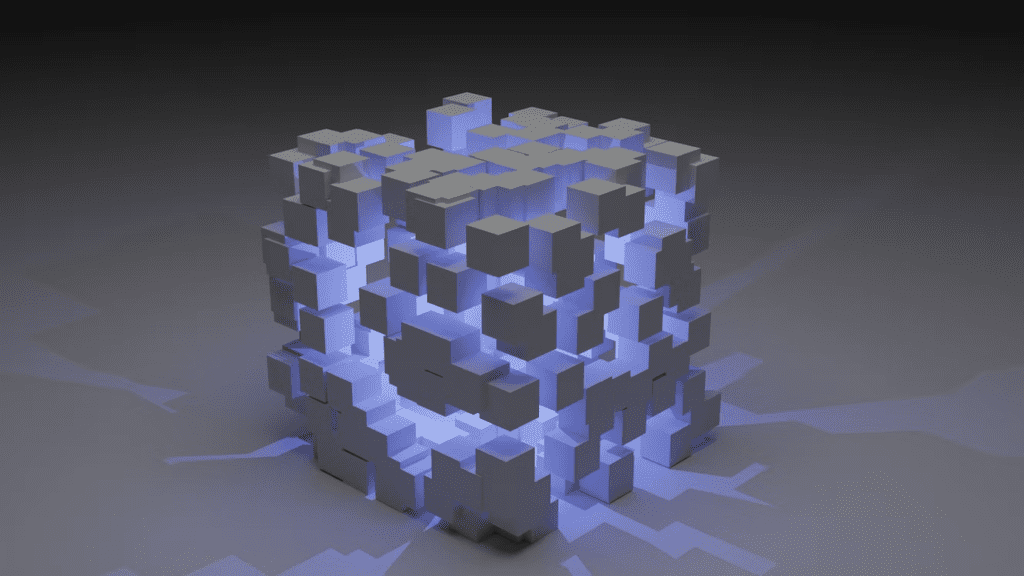

What the image depicts above is a decentralized market – it’s essentially a series of blockchains that knit together to create the decentralized market that millions of people now use. To understand a decentralized market, it’s perhaps worth having a brief overview of the centralized market so you can compare the two along the way. A centralized market means all transactions and orders flow in a way that allows all orders (purchase and sale) to be transferred to a central exchange. The New York Stock Exchange is the perfect example – money constantly flows between businesses and individuals with the security of institutional financial organizations. With that in mind, let’s look at the decentralized network and its security.

Decentralized Market

Decentralized markets, also known as decentralized exchanges (DEXs), are a type of cryptocurrency exchange that operates on a blockchain network in a decentralized manner. Unlike centralized exchange platforms, decentralized exchanges function on a peer-to-peer (P2P) basis, allowing users to buy and sell cryptocurrencies directly at various fluctuating rates. For example, the Chia Price constantly fluctuates along with many other coins, making it a highly volatile market.

Decentralized exchanges use smart contracts and blockchain technology to facilitate transactions and ensure that they are executed securely and transparently. When a user places an order on a decentralized exchange, the order broadcasts to the network, and other users can match the order by agreeing to buy or sell at the stated price.

Decentralized exchanges offer several advantages over centralized exchanges. First, users have greater control over their funds, as users retain ownership and control of their private keys throughout the trading process. Decentralized exchanges are generally more resistant to hacking and other security breaches. There isn’t a constant exchange of money between different organizations and bank accounts.

That’s not to say that the decentralized market isn’t without flaws. For example, they typically have lower trading volumes and liquidity compared to centralized exchanges, which can result in wider bid-ask spreads and longer wait times for orders to be matched. Additionally, decentralized exchanges may be less user-friendly and require more technical knowledge to use effectively.

What Security Features Does The Misunderstood Network Have?

A decentralized network operates on a distributed architecture where the data is stored on multiple nodes. That means there is no central point of failure, and even if some nodes are compromised, the network can continue to operate. What does that mean? It means multiple nodes have to agree to something before an action happens. They all need to have the same data to authorize a transaction.

It also means there’s an extra layer of security because, in addition to there being no central point of failure, there is no central point of access. Decentralized networks have no central authority, meaning that one single entity doesn’t have control over the network. That makes it more difficult for attackers to compromise the network by attacking a central point of control.

Decentralized security also works a lot differently from centralized security. Decentralized networks use cryptographic protocols to ensure secure transactions and communications between nodes. That includes using public-key encryption, digital signatures, and hashing algorithms to secure data. There’s also the consensus mechanism. A consensus mechanism ensures that all nodes in the network agree on the state of the network. That helps to prevent attacks such as double-spending, where a user spends the same funds twice.

So What Are The Security Risks?

There are security risks to everything involving finances, so it’s not to throw shade at the decentralized network. One of the risks is an inherent lack of recovery mechanisms. Decentralized networks are designed to be immutable, meaning data cannot be changed or deleted once added. While this provides a high level of security, it also means that there are no recovery mechanisms in place if a user loses their private key or accidentally sends funds to the wrong address. It’s not as simple as forgetting your password to your online banking and asking for a new one.

There are also unique hacks and attacks on the decentralized world known as 51% attacks. In a decentralized network, the security of the network depends on the consensus mechanism that is used. A 51% attack can only occur if a single entity controls in excess of 50% of the available computing power that resides within that network, allowing them to manipulate the network and potentially carry out fraudulent transactions.

There’s also the simplicity of a lack of regulation. Who do you turn to if someone steals your money? Decentralized networks operate outside the purview of traditional regulatory bodies, which can make them attractive to criminals looking to engage in illegal activities such as money laundering or terrorist financing.

Although there are some security risks that the decentralized network faces, it is still one of the most secure networks compared to its centralized counterpart. Security, however, is something you can trust. The protocols and management of security are unique to the cryptocurrency world, but that doesn’t mean you can’t trust it. The more time you spend understanding the decentralized network, the more you will understand the users are behind the drive for better security, implementing new layers of protection almost daily.